WORLD STEEL RECYCLING IN FIGURES

January-March 2021 update

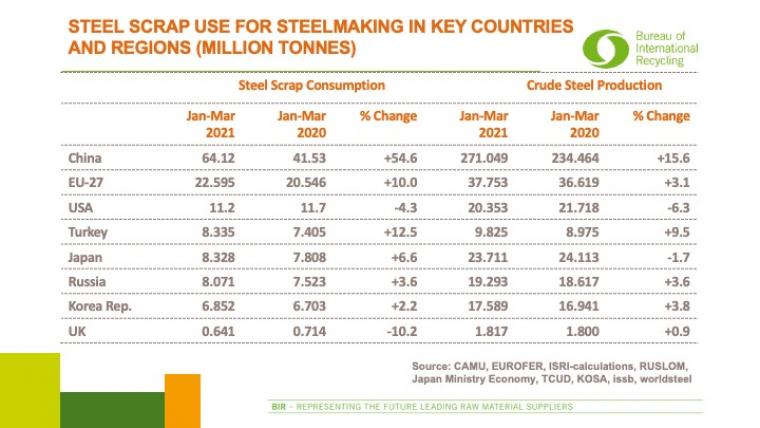

Global crude steel production totalled 486.9 million tonnes in the first three months of 2021 for an increase of 10% over the same period in 2020. According to worldsteel, Asia and Oceania alone produced 356.9 million tonnes of crude steel in the first quarter of 2021 - an increase of 13.2% compared to last year.

Data in our corresponding table show a crude steel production increase in China of 15.6% to 271 million tonnes compared to the first quarter of 2020. There was also growth in crude steel production in the EU-27 (+3.1% to 37.753 million tonnes), Turkey (+9.5% to 9.825 million tonnes), Russia (+3.6% to 19.293 million tonnes) and the Republic of Korea (+3.8% to 17.589 million tonnes). Following the completion of Brexit, the UK is welcomed as a new key country in our table and saw a crude steel production increase in the first three months of 2021 of 0.9% to 1.817 million tonnes. Conversely, declines were registered by the USA (-6.3% to 20.353 million tonnes) and Japan (-1.7% to 23.711 million tonnes).

China increases steel scrap usage by 54.6%

According to our statistics, China’s steel scrap consumption soared 54.6% to 64.12 million tonnes in the first three months of 2021; this compares to 41.53 million tonnes in the same period of 2020. This strong increase in steel scrap usage can be attributed partly to the weaker figures for the first quarter of 2020 as a result of the COVID pandemic. It also reflects the goal of higher steel scrap usage announced in China’s latest Five-Year Plan so as to reduce CO2 emissions from crude steel production. China has thus solidified its position as the world’s largest steel scrap user.

Steel scrap usage also increased in the first three months of this year in the EU-27 (+10% to 22.595 million tonnes), Japan (+6.6% to 8.328 million tonnes), Turkey (+12.5% to 8.335 million tonnes), Russia (+3.6% to 8.071 million tonnes) and the Republic of Korea (+2.2% to 6.852 million tonnes). Conversely, there were declines in steel scrap consumption in the UK (-10.2% to 0.641 million tonnes) and in the USA (-4.3% to 11.2 million tonnes).

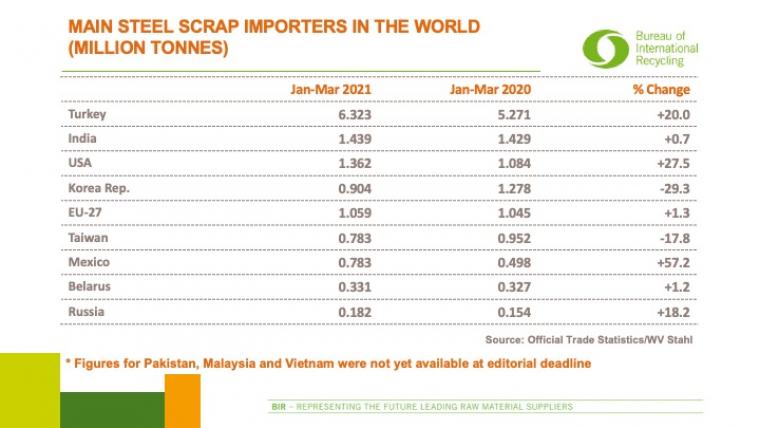

Turkey’s overseas steel scrap purchases climb 20%

The first three months of 2021 brought a 20% increase in Turkey’s overseas steel scrap purchases to 6.329 million tonnes, confirming the country once again as the world’s foremost steel scrap importer. India, the world’s second-largest importer, increased its overseas purchases by 0.7% to 1.439 million tonnes in the January-March 2021 period while the USA, third on the list of steel scrap importers, upped its tally by 27.5% to 1.362 million tonnes.

Also higher in the first three months of this year were steel scrap imports into the EU-27 (+1.3% to 1.059 million tonnes), Mexico (+57.2 to 0.783 million tonnes), Belarus (+1.2% to 0.331 million tonnes) and Russia (+18.2% to 0.182 million tonnes). Conversely, import declines were recorded by the Republic of Korea (-29.3% to 0.904 million tonnes) and Taiwan (-17.8 to 0.783 million tonnes).

Figures for Pakistan, Malaysia and Vietnam were not available ahead of our editorial deadline.

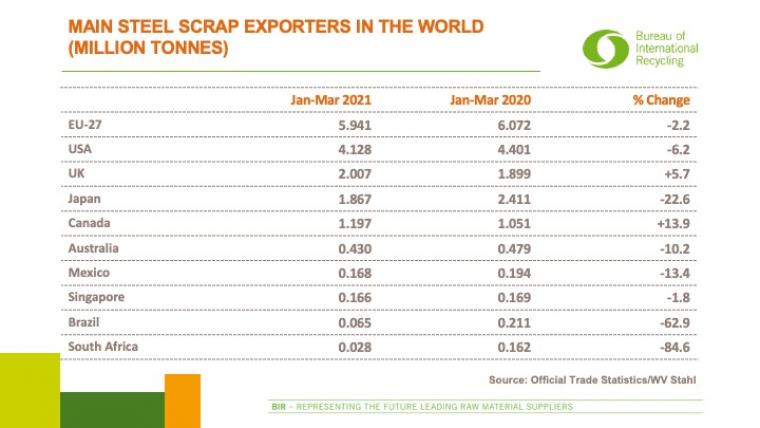

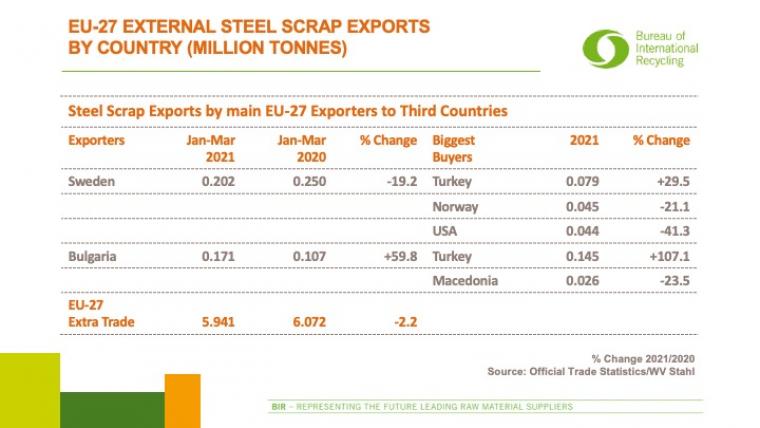

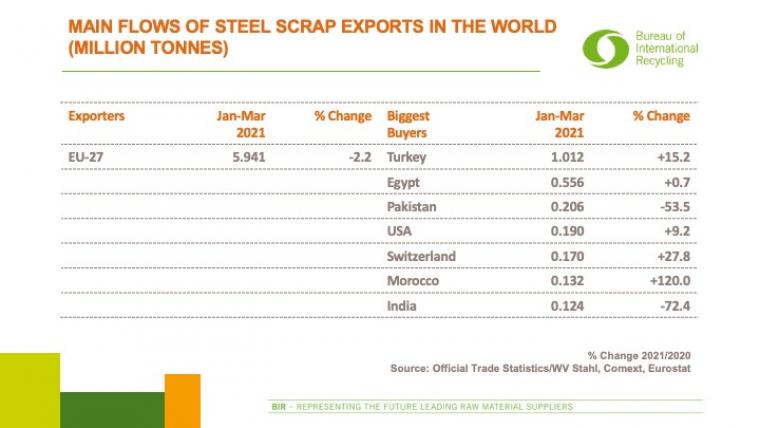

EU-27 steel scrap exports down 2.2%

The EU-27 reduced its outbound shipments of steel scrap by 2.2% to 5.941 million tonnes in the first three months of this year but remained the world’s leading exporter. The EU-27 increased its shipments to main buyer Turkey by 15.2% to 1.012 million tonnes, as well as to Egypt (+0.7% to 0.556 million tonnes), the USA (+9.2% to 0.190 million tonnes), Switzerland (+27.8% to 0.170 million tonnes) and Morocco (+120% to 0.132 million tonnes). At the same time, a drop was recorded in deliveries to Pakistan (-53.5% to 0.206 million tonnes) and to India (-72.4% to 0.124 million tonnes). EU-27 internal steel scrap exports totalled 7.361 million tonnes in the first quarter of 2021 for a year-on-year increase of 7.7%.

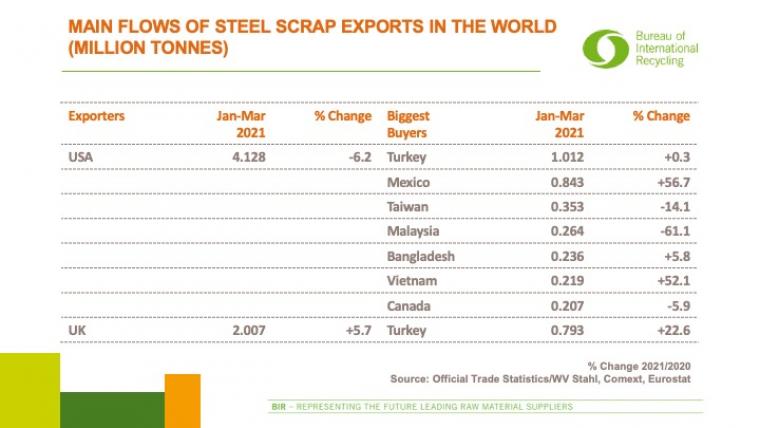

The first three months of this year brought a decrease in US steel scrap exports of 6.2% to 4.128 million tonnes; among the leading buyers to extend their purchases from the USA were main customer Turkey (+0.3% to 1.012 million tonnes), Mexico (+56.7% to 0.843 million tonnes), Bangladesh (+5.8% to 0.236 million tonnes) and Vietnam (+52.1% to 0.219 million tonnes). In contrast, decreases in US scrap deliveries were recorded by Taiwan (-14.1% to 0.353 million tonnes), Malaysia (-61.1% to 0.264 million tonnes) and Canada (-5.9% to 0.207 million tonnes).

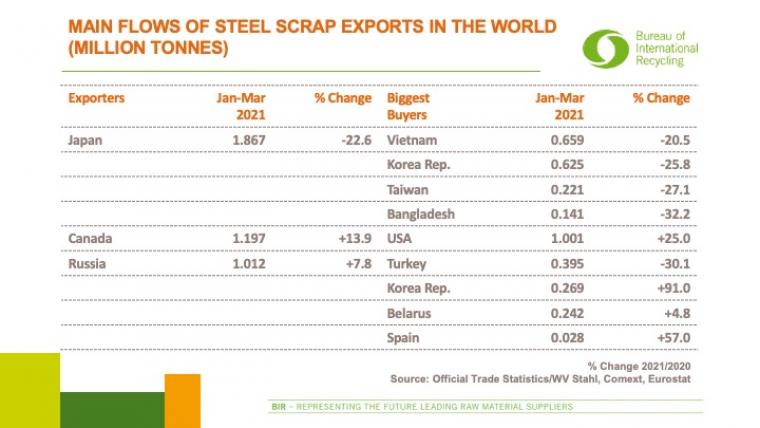

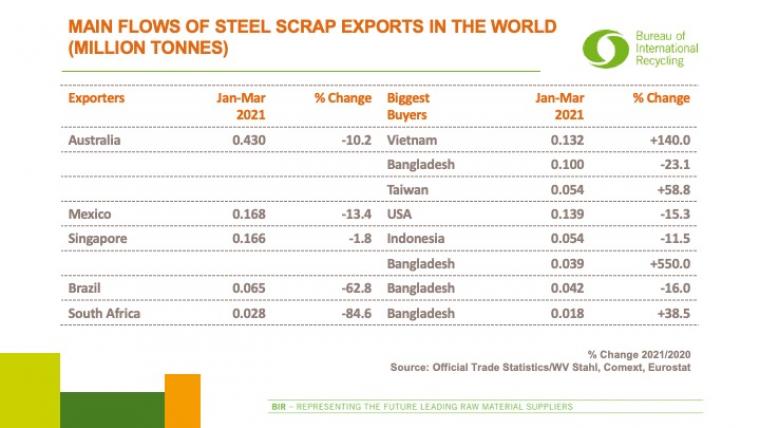

Also in this year’s January-March period, an increase was recorded in steel scrap exports from the UK (+5.7% to 2.007 million tonnes), including to its biggest buyer Turkey (+22.6% to 0.793 million tonnes). Higher exports were also recorded by Canada (+13.9% to 1.197 million tonnes) and Russia (+7.8% to 1.012 million tonnes) whereas declines in overseas shipments were registered by Australia (-10.2% to 0.430 million tonnes), Singapore (-1.8% to 0.166 million tonnes), Mexico (-13.4% to 0.168 million tonnes), Brazil (-62.8% to 0.065 million tonnes) and South Africa (-84.6% to 0.028 million tonnes).

Last but not least, I would like to extend my special thanks to Daniela Entzian, the BIR Ferrous Division’s Deputy Statistics Advisor, for her excellent co-operation.

Rolf Willeke

Statistics Advisor of the BIR Ferrous Division

Country

World Steel Recycling in Figures

World Steel Recycling in Figures