WORLD STEEL RECYCLING IN FIGURES

January-June 2020 update

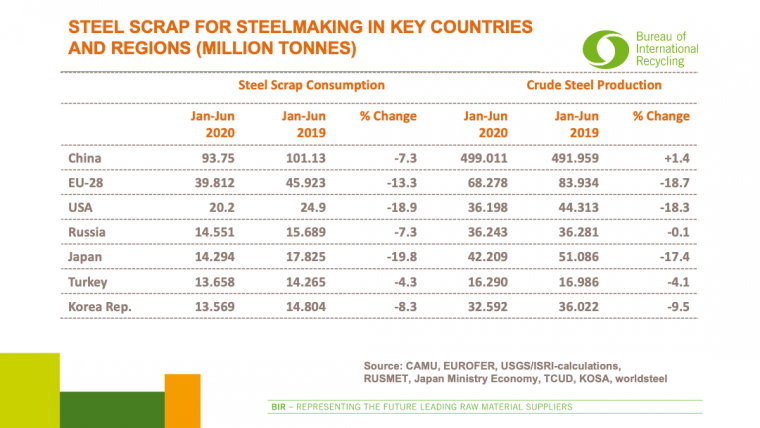

According to worldsteel, global crude steel production totalled 873 million tonnes in the first six months of 2020 - down 6% from the same period in 2019.

Data in the corresponding table show a year-on-year crude steel production increase for China alone (+1.4% to 499.011 million tonnes). Conversely, production declines were registered by the EU-28 (-18.7% to 68.278 million tonnes), the USA (-18.3% to 36.198 million tonnes), Japan (-17.4% to 42.209 million tonnes), Russia (-0.1% to 36.243 million tonnes), the Republic of Korea (-9.5% to 32.592 million tonnes) and Turkey (-4.1% to 16.290 million tonnes).

China reduces steel scrap usage by 7.3%

In the first six months of 2020, there was a 7.3% drop in China’s steel scrap usage for crude steel production to 93.75 million tonnes, as compared to 101.13 million tonnes for the same period in 2019. However, steel scrap consumption of 52.22 million tonnes in the second quarter of 2020 was 25.7% higher than the 41.53 million tonnes consumed in the first quarter. These figures confirm that China remained the world’s largest steel scrap user during the period under review.

Also in the first half of 2020, steel scrap usage for crude steel production dropped in the EU-28 (-13.3% to 39.812 million tonnes), the USA (-18.9% to 20.2 million tonnes), Russia (-7.3% to 14.551 million tonnes), Japan (-19.8% to 14.294 million tonnes) and the Republic of Korea (-8.3% to 13.569 million tonnes).

Meanwhile, Turkey reported a steel scrap usage decrease of 4.3% to 13.658 million tonnes, with the reduction in scrap-intensive electric furnace production (-4.3% to 11.419 million tonnes) being slightly more pronounced than the drop in the country’s crude steel production (-4.1%).

The table illustrates the negative influence of the Coronavirus pandemic on global steel scrap use and crude steel output.

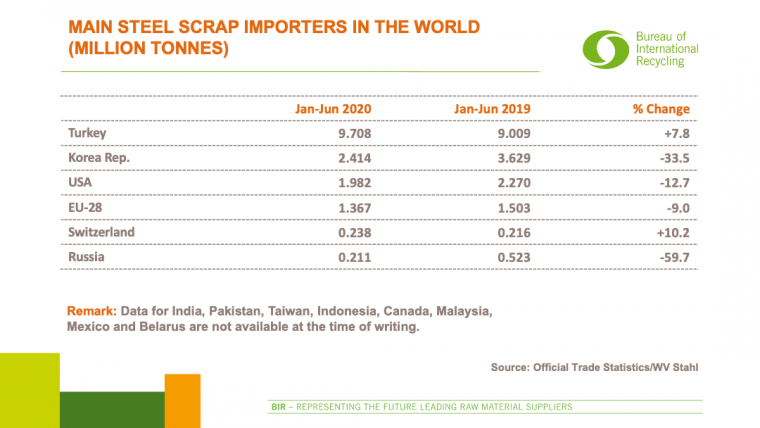

Turkey increases overseas steel scrap purchases by 7.8%

The first six months of 2020 brought a 7.8% year-on-year upturn in Turkey’s overseas steel scrap purchases to 9.009 million tonnes, confirming the country’s position as the world’s foremost steel scrap importer. Also higher over the same period was Switzerland’s steel scrap import total (+10.2% to 0.238 million tonnes).

Conversely, a steep drop in overseas purchases was recorded by the Republic of Korea, the world’s third-largest steel scrap importer (-33.5% to 2.414 million tonnes). Declines were also reported by the USA (-12.7% to 1.982 million tonnes), the EU-28 (-9% to 1.367 million tonnes) and Russia (-59.7% to 0.211 million tonnes). Data for India, the second-largest steel scrap importer, and for Pakistan, Taiwan, Indonesia, Canada, Malaysia, Mexico and Belarus are not available at the time of writing.

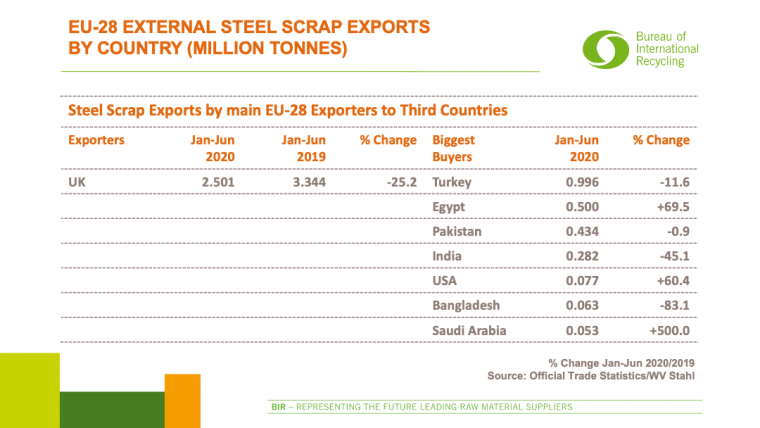

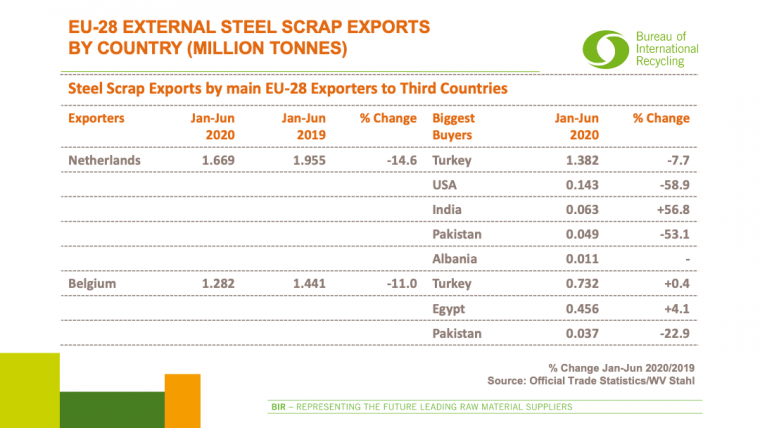

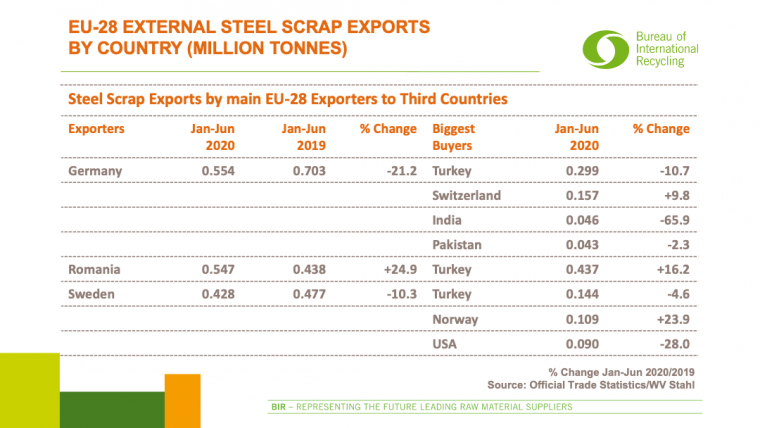

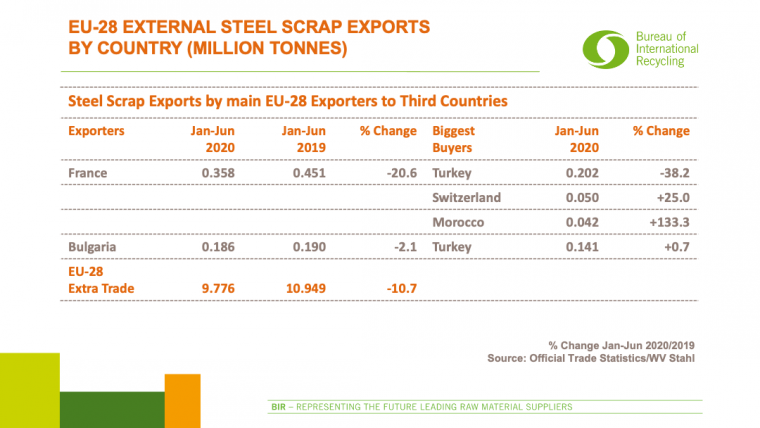

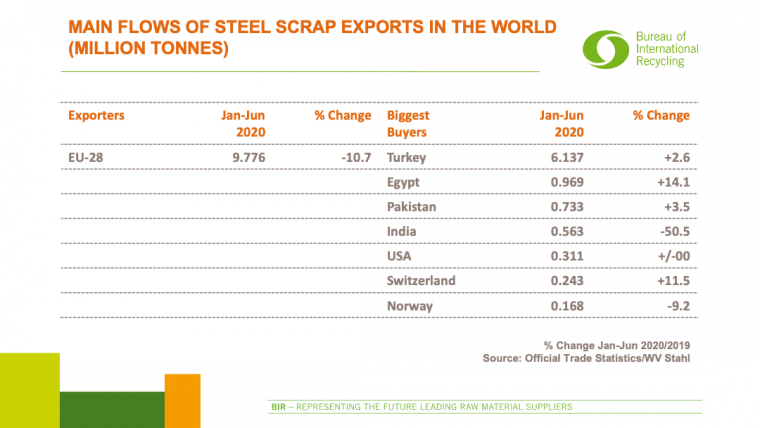

EU-28 remains leading steel scrap exporter

The first half of 2020 brought a 10.7% decline in the EU-28’s overseas shipments to 9.776 million tonnes but it nevertheless remained the world’s leading steel scrap exporter during the period under review. There were decreases in the EU-28’s outbound shipments to India (-50.5% to 0.563 million tonnes) and to Norway (-9.2% to 0.168 million tonnes). Conversely in the first six months of 2020, there were increases in EU-28 deliveries to Turkey (+2.6% to 6.137 million tonnes), Egypt (+14.1% to 0.969 million tonnes), Pakistan (+3.5% to 0.733 million tonnes) and Switzerland (+11.5% to 0.243 million tonnes). Shipments to the USA were unchanged on 0.311 million tonnes.

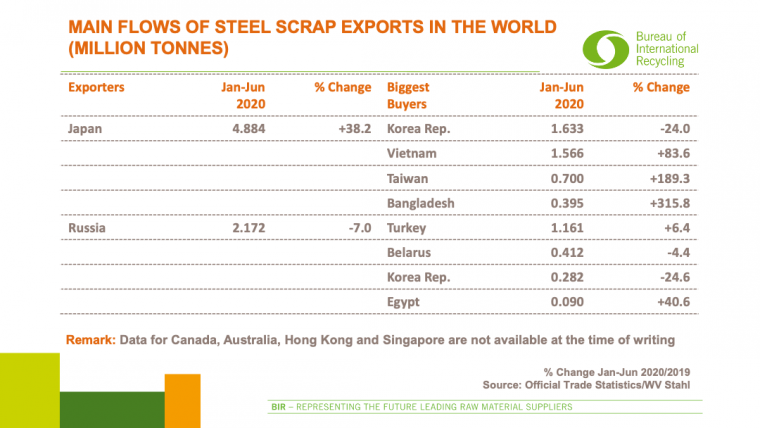

The first six months of 2020 also brought a fall in US overseas steel scrap exports (-2.3% to 8.401 million tonnes), with reduced shipments to Taiwan (-2.6% to 0.850 million tonnes), Canada (-32.4% to 0.614 million tonnes) and the Republic of Korea (-46.1% to 0.390 million tonnes). Higher US steel scrap exports were recorded in the first half of 2020 to Turkey (+11.2% to 1.951 million tonnes), Mexico (+36.1% to 0.950 million tonnes), Malaysia (+104.3% to 0.901 million tonnes) and Bangladesh (+33.3% to 0.605 million tonnes).

Russia’s overseas steel scrap shipments were also lower during the same period (-7% to 2.172 million tonnes); its leading customer was Turkey (+6.4% to 1.161 million tonnes). In contrast, Japan’s overseas shipments of steel scrap soared 38.2% to 4.884 million tonnes in the first half of 2020: the main buyers were the Republic of Korea (-24% to 1.633 million tonnes), Vietnam (+83.6% to 1.566 million tonnes), Taiwan (+189.3% to 0.700 million tonnes) and Bangladesh (+315.8% to 0.395 million tonnes). Data for Canada, Australia, Hong Kong and Singapore are not available at the time of writing.

I would like to offer my special thanks to Daniela Entzian, the BIR Ferrous Division’s Deputy Statistics Advisor, for her excellent co-operation in compiling these figures.

Rolf Willeke

Statistics Advisor of the BIR Ferrous Division

Country

World Steel Recycling in Figures

World Steel Recycling in Figures