WORLD STEEL RECYCLING IN FIGURES

January-December 2019 update

Global crude steel production totalled 1.870 billion tonnes in 2019, up 3.4% from the previous year. According to worldsteel, however, crude steel production contracted in all regions last year with the exception of Asia and the Middle East.

Worldwide, oxygen furnace production increased by 6.5% to 1.343 billion tonnes whereas the global electric furnace total was virtually unchanged at 523 million tonnes. There was a small increase in global blast furnace iron production (+2.5% to 1.278 billion tonnes) and also in DRI production (+2.4% to 90.2 million tonnes).

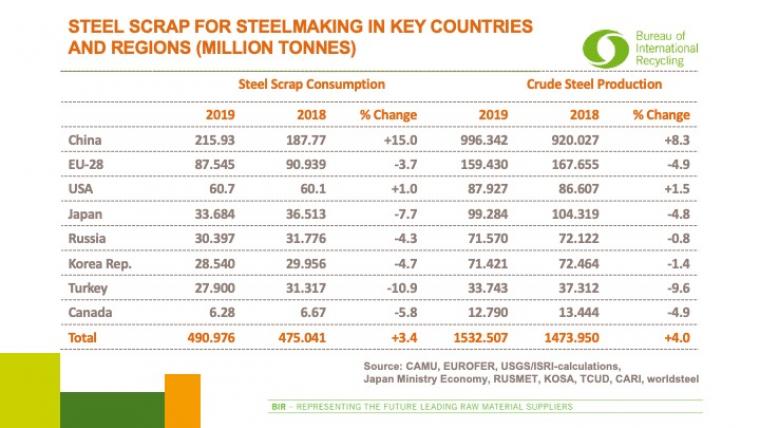

Data in our corresponding table show a year-on-year crude steel production increase for China of 8.3% to 996.342 million tonnes, lifting the country’s share of global production from 50.9% in 2018 to 53.3% in 2019. There was also growth in US crude steel production (+1.5% to 87.927 million tonnes) whereas declines were registered by the EU-28 (-4.9% to 159.430 million tonnes), Japan (-4.8% to 99.284 million tonnes), Russia (-0.8% to 71.570 million tonnes), the Republic of Korea (-1.4% to 71.421 million tonnes), Turkey (-9.6% to 33.743 million tonnes) and Canada (-4.9% to 12.790 million tonnes).

China’s steel scrap usage surges 15%

According to our statistics, steel scrap consumption soared by 15% in China last year to 215.93 million tonnes. This compares to 187.77 million tonnes in 2018 and serves to underline China’s position as the world’s largest steel scrap user. The proportion of steel scrap used in the country’s steel production climbed to 21.7%.

This increase was mainly due to higher pollutant emission standards for the Chinese steel industry. Most of the country’s BOF mills have actively increased scrap inputs and their steel scrap/crude steel ratio is currently said to be 20.2%. There was also a further increase in China’s scrap-intensive electric furnace production from 54 million tonnes in 2017 to 103.2 million tonnes last year, according to worldsteel.

Steel scrap usage also increased in the USA last year (+1% to 60.7 million tonnes). Conversely, there were declines in steel scrap consumption in the EU-28 (-3.7% to 87.545 million tonnes), Japan (-7.7% to 33.684 million tonnes), Russia (-4.3% to 30.397 million tonnes), the Republic of Korea (-4.7 to 28.540 million tonnes) and Turkey (-10.9% to 27.900 million tonnes). According to the Turkish Steel Producers Association, the underlying reason for the domestic decline was last year’s 11.3% drop in electric furnace production whereas domestic BOF production fell by only 5.7%. There was also a decline in steel scrap consumption in our new key country of Canada (-5.8% to 6.28 million tonnes).

Steel scrap usage in key countries/regions amounts to 491 million tonnes

In adding 2018 and 2019 data for Canada to our table, this means steel scrap usage in eight key countries and regions totalled around 491 million tonnes (+3.4% compared to the previous year) while related crude steel production was around 1.533 billion tonnes (+4%). The figure of 491 million tonnes of steel scrap usage represents verified data for 82% of global steelmaking in 2019.

Canada’s domestic steel scrap consumption data were collated by the Canadian Steel Producers Association on behalf of Tracy Shaw (President & CEO of the Canadian Association of Recycling Industries), to whom we would like to extend our deepest thanks. We are hopeful of achieving a similar co-operation with Zain Nathani (Vice-President of the BIR Ferrous Division) so as to enable us to add India to our table.

Turkey’s steel scrap imports decline by 8.7%

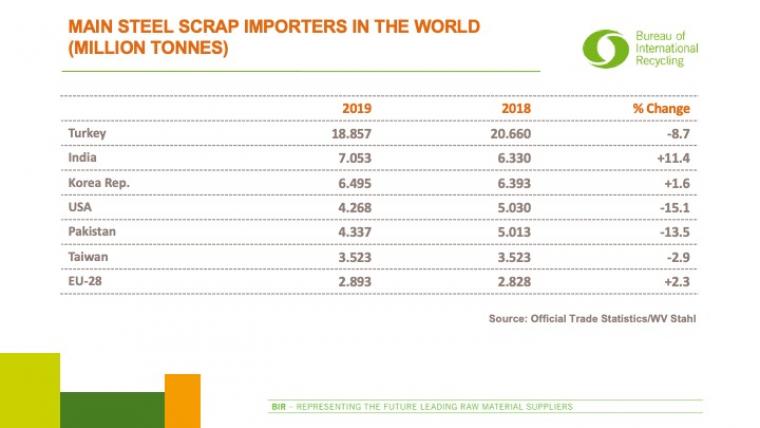

Last year brought an 8.7% year-on-year decline in Turkey’s overseas steel scrap purchases to 18.857 million tonnes. As indicated in our previous report, the main factors behind this reduction were additional US import tariffs on Turkish steel and sluggish long steel demand in the domestic and export markets. However, Turkey’s steel scrap imports are understood to have increased significantly in December last year to 2.041 million tonnes (+25.4% over the previous month). Despite the overall decline, the data for 2019 confirm that Turkey remained the world’s foremost steel scrap importer.

Also last year, India reinforced its position as the world’s second-largest steel scrap importer with an 11.4% increase in its overseas steel scrap purchases to 7.053 million tonnes. At the same time, third-placed Republic of Korea upped its scrap imports by 1.6% to 6.495 million tonnes.

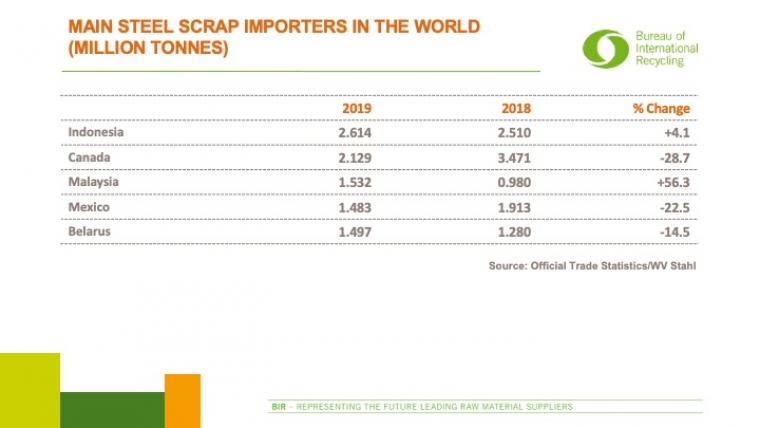

Also higher in 2019 were steel scrap imports into the EU-28 (+2.3% to 2.893 million tonnes), Indonesia (+4.1% to 2.614 million tonnes) and Malaysia (+56.3% to 1.532 million tonnes). In contrast, import declines were recorded by the USA (-15.1% to 4.268 million tonnes), Pakistan (-13.5% to 4.337 million tonnes), Taiwan (-2.9% to 3.523 million tonnes), Canada (-38.7% to 2.129 million tonnes), Mexico (-22.5% to 1.483 million tonnes), and Belarus (-14.5% to 1.497 million tonnes).

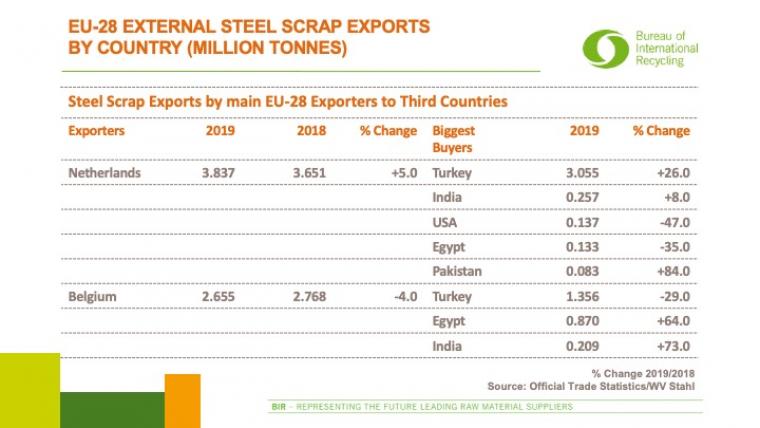

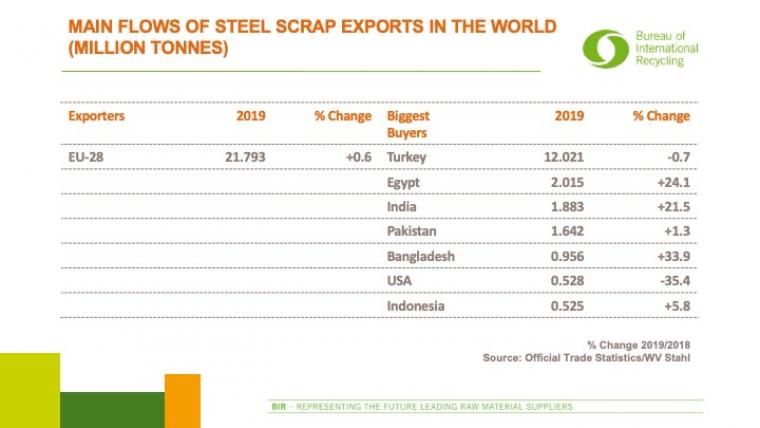

EU-28 overseas steel scrap shipments climb 0.6%

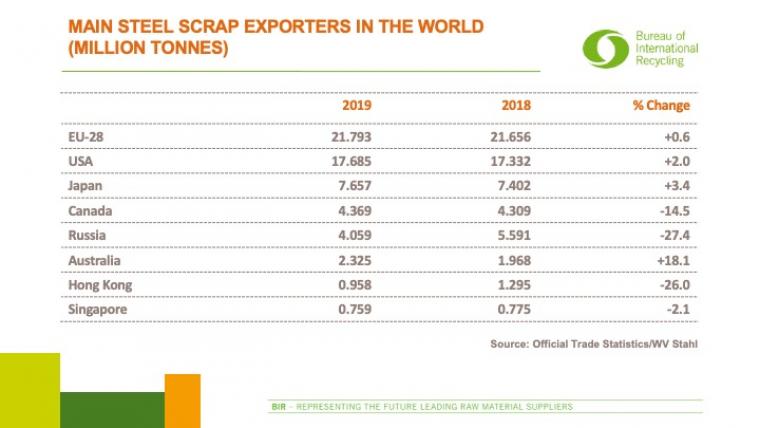

The EU-28 remained the world’s leading steel scrap exporter in growing its outbound shipments in 2019 by 0.6% to 21.793 million tonnes, the main buyer being Turkey on 12.021 million tonnes (-0.7% year on year). The EU-28 increased its overseas shipments to Egypt (+24.1% to 2.015 million tonnes), India (+21.5% to 1.883 million tonnes), Pakistan (+1.3% to 1.642 million tonnes), Bangladesh (+33.9% to 0.956 million tonnes) and Indonesia (+5.8% to 0.525 million tonnes). Conversely, a further drop was recorded in EU-28 deliveries to the USA (-35.4% to 0.528 million tonnes). The largest EU-28 steel scrap exporter was the UK with a 2019 shipment total of 6.613 million tonnes (-6% compared to the previous year).

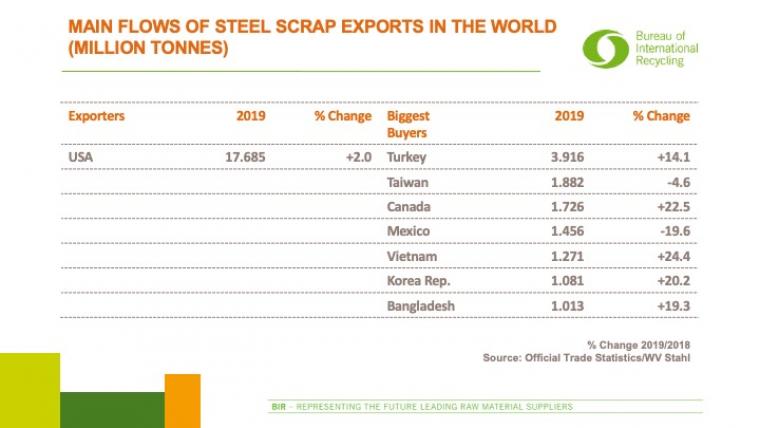

Last year brought an increase in US overseas steel scrap shipments of 2% to 17.685 million tonnes; among the leading buyers to extend their purchases from the USA were main customer Turkey (+14.1% to 3.916 million tonnes), Canada (+22.5% to 1.726 million tonnes), Vietnam (+24.4% to 1.271 million tonnes), the Republic of Korea (+20.2% to 1.081 million tonnes) and Bangladesh (+19.3% to 1.013 million tonnes). In contrast, decreases in US scrap deliveries were recorded by Taiwan (-4.6% to 1.882 million tonnes) and Mexico (-19.6% to 1.456 million tonnes).

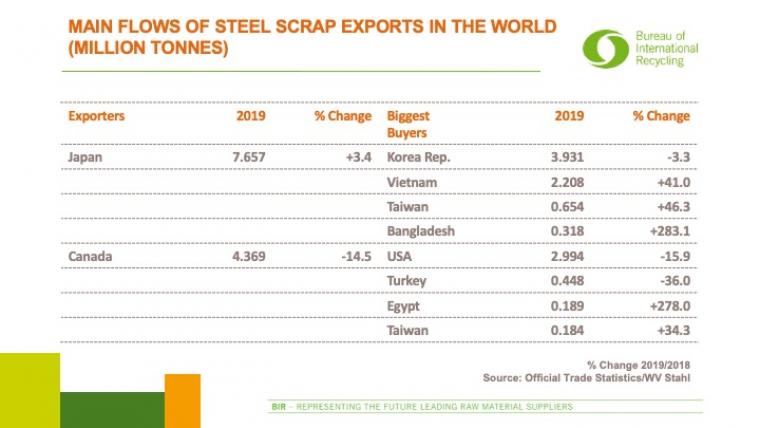

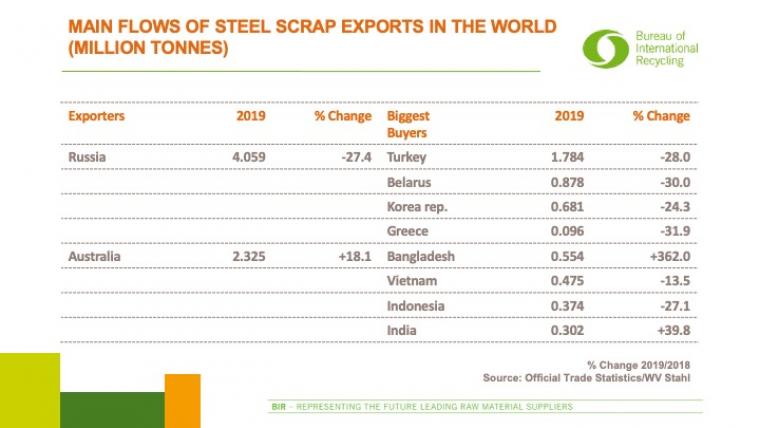

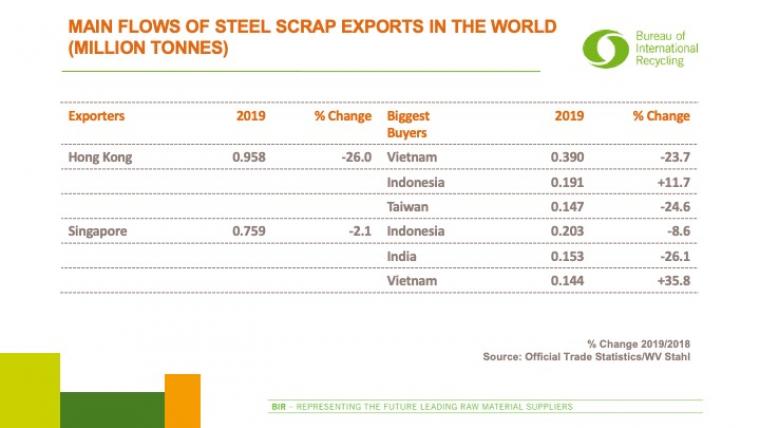

Last year, increases were recorded in steel scrap exports from Australia (+18.1% to 2.325 million tonnes) and Japan (+3.4% to 7.657 million tonnes) whereas declines in overseas shipments were registered by Canada (-14.5% to 4.369 million tonnes), Hong Kong (-26% to 0.958 million tonnes) and Singapore (-2.1% to 0.759 million tonnes). A 27.4% decline in Russia’s outbound shipments to 4.058 million tonnes in 2019 reflected the early effects of the government’s decision to restrict ferrous scrap exports through quotas from the end of August last year.

Last but not least, I would like to extend my special thanks to Daniela Entzian, the BIR Ferrous Division’s Deputy Statistics Advisor, for her excellent co-operation in the collation of these data.

Rolf Willeke

Statistics Advisor of the BIR Ferrous Division

Country

World Steel Recycling in Figures

World Steel Recycling in Figures